It is the score (300-900) that determines the creditworthiness of the individual.

Here are some steps you can take now to improve your score.

1.Pay EMIs on time

This make a vital role in determining your cibil score. So, make your payments in time to increase your score. If you have missed any payments, it will last 3 years.

2.Don't apply for 2-3 credit cards or loans at one time.

Usually, people think that applying for multiple credit cards or loans won't affect your cibil score. But it adversely affects it. It shows that the individual is credit hungry.

3.Dispute Inaccuracies

There are many websites like BankBazaar, PaisaBazaar, etc. which provides cibil score at absolutely no cost. Check your cibil report thoroughly, if there is any inaccuracy in data quickly report to cibil.

4.Check for Joint Applicants

If you are a loan guarantor to someone then make sure that the applicant pays his/her payments on time. If they not, then it will affect your cibil score, too.

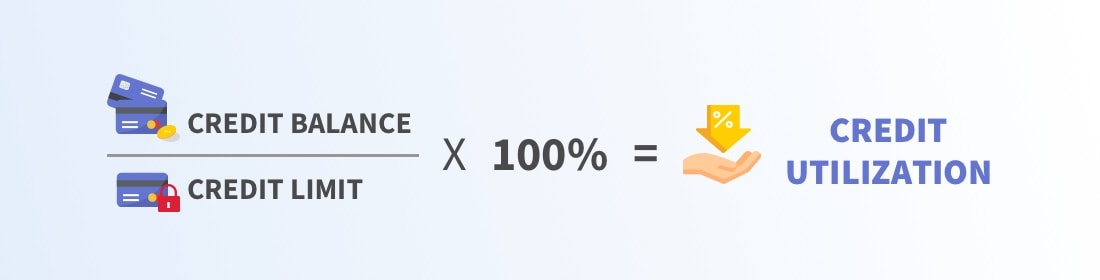

5.Credit Utilisation Ratio

If you have a credit card, then try to use only 50% of the credit limit because if you use till 80-90% limit then again it will account you as credit hungry.

Hope you enjoyed the blog.

Stay tuned for more updates at Finance Guru.

2 Comments

👍🏻👍🏻

ReplyDelete👏👏👏

ReplyDelete