You might have heard about Mutual Funds in an advertisement.

Have you ever thought about why 'Mutual Funds Sahi Hai'? If not, so let's explain it in great detail.

What are Mutual Funds?

A mutual fund is nothing but a collection of stocks that is managed by a professional Fund Manager on your behalf.

So, your task is just to invest your money through any AMC website/app.

Asset Management Companies(AMC) are the ones who manage your money by appointing a Fund Manager. He/She decides how many stocks to buy/sell, etc.

Just like in the stock market you have a share price for each company, in mutual funds we have units known as NAV(Net Asset Value).

Why choose Mutual Funds?

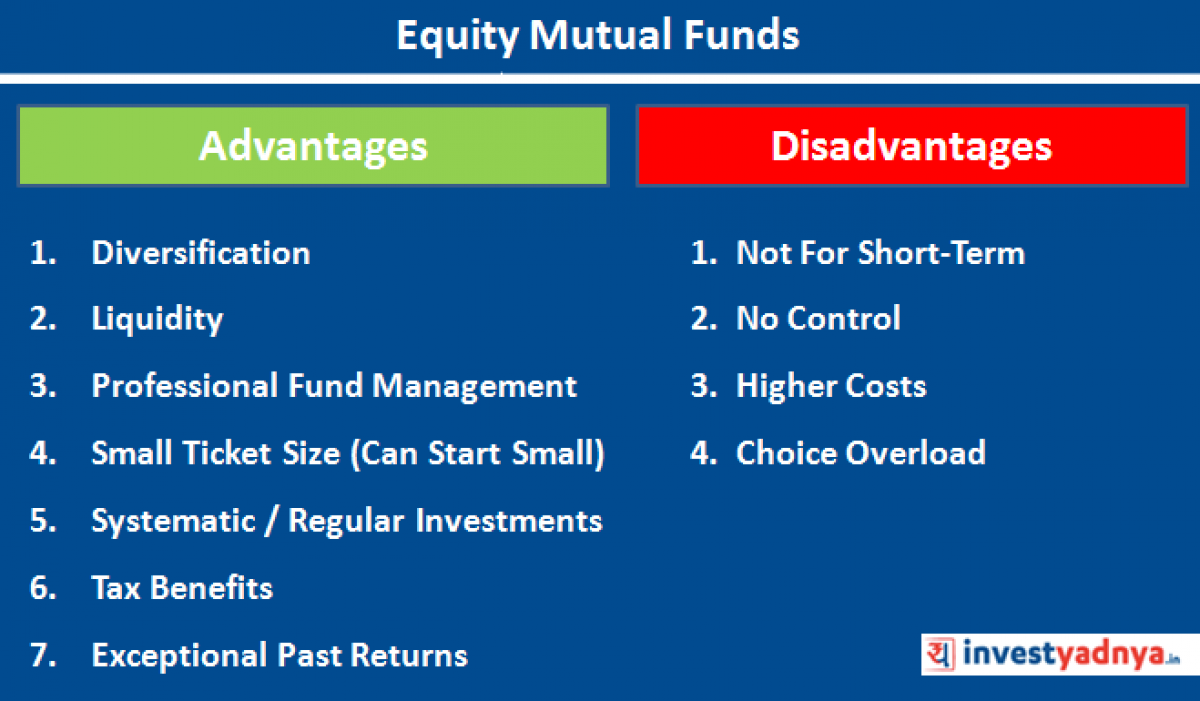

Mutual Funds have plenty of advantages.

1.)Liquidity: You can withdraw your money at any time, unlike Fixed Deposits by paying a small fee(mostly 1-2% of your returns) known as exit load.

2.)Diversification: It is a technique of diversifying your investment across various sectors. It helps in reducing the risk in a portfolio

3.)Higher Returns: Unlike FDs which give you around 5-7% returns with a lock-in period, mutual funds give easily around 8-15% returns and with no lock-in period.

3.)Hybrid: They invest in both equity and bonds. They provide moderate returns and have moderate risk attached to them.

4.)Others: They invest in gold, real estate, commodities, etc. They also provide moderate returns and have moderate risk attached to them.

You can start investing in mutual funds through any AMC website/app. There are many third party apps like groww,ET money,etc. We are providing one mutual fund app link below.

Groww App

0 Comments